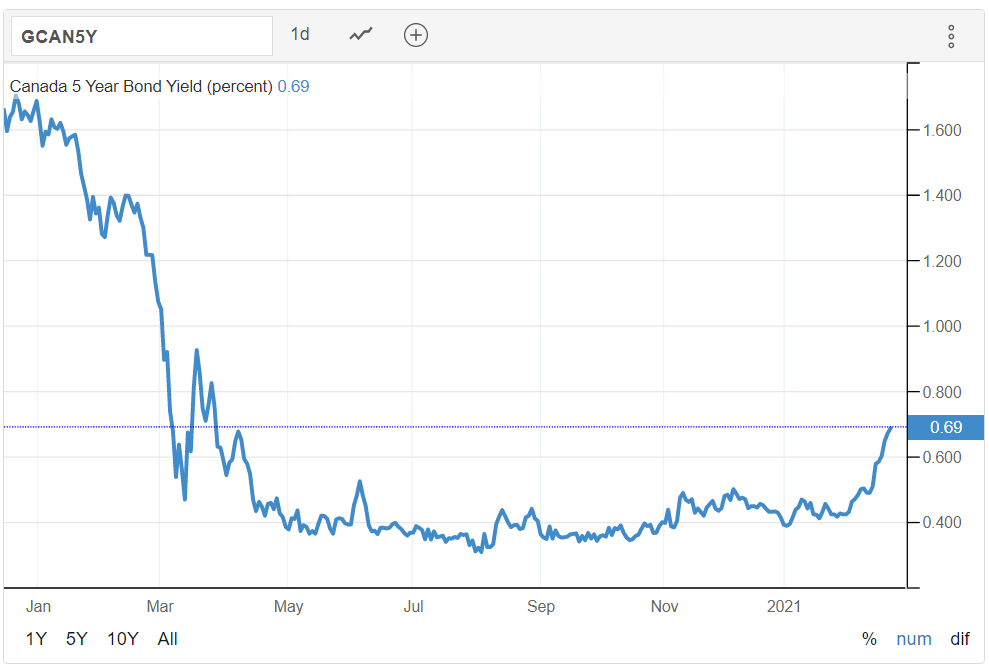

Market Interest Rates Are Rising Almost Everywhere

Longer-Term Yields are Rising Despite Central Bank Inaction

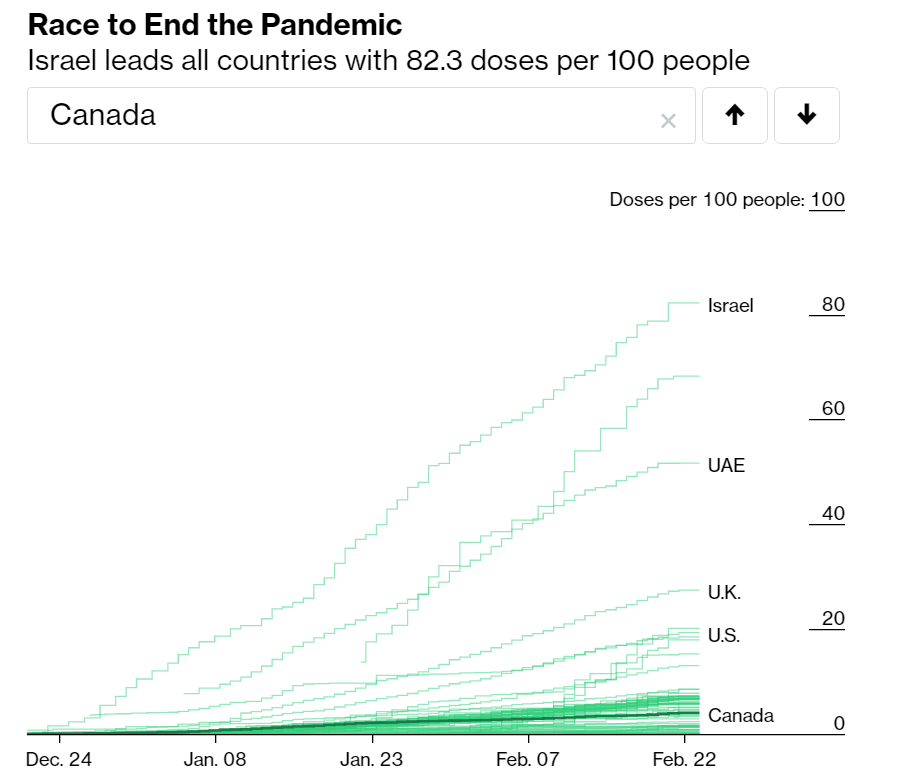

Keep in mind that Canada’s economy has considerable slack with unemployment rising in recent months and the lockdown continuing for at least a couple more weeks in the GTA. Moreover, Canada has fallen far beyond other countries in the vaccine rollout.

The biggest vaccination campaign in history is currently underway. More than 209 million doses have been administered across 92 countries, according to data collected by Bloomberg News. The latest pace was roughly 6.24 million doses a day. Israel has administered more than 82 doses of vaccine per 100 people, the UK is at 27.5, and the US is at 19.3. Canada, on the other hand, has administered only 4.1 doses per 100 people, now ranking 43rd in the world (see chart below).

This slow start to the rollout likely portends a longer period of economic underperformance.

Bottom Line

Some upward pressure on fixed mortgage rates might be in store, although the Big Five Banks have yet to respond, and the qualifying rate remains at 4.79%, well above contract rates. Without any prospect of near-term tightening by the Bank of Canada, variable rate mortgage rates–typically tied to the prime rate–will remain stable. But mortgage rates have moved up at some of the non-bank lenders. No question, the economy’s trajectory and interest rates will be linked to the return to the ‘new normal’ following the pandemic. Good news on the pandemic front inevitably means higher mortgage rates in 2022-23–if not sooner.

This article was written by DLC's Chief Economist Dr Sherry Cooper and was syndicated with permission.