Historic Job Losses in April in Canada as the Economy Bottoms

Pandemic Batters Canadian Jobs Market

The Canadian economy has been put in a medically induced coma. Never before in modern history have we seen a forced shutdown in the global economy, so not surprisingly, the incoming data for April are terrible. There is a good chance, however, that April will mark the bottom in economic activity as regions begin to ease restrictions.

The economy will revive, but the psychological shock is perhaps the most unnerving. Rest assured, however, that as severe as this is, there are real opportunities here along with the challenges. There are economic winners, not just losers. More on that later.

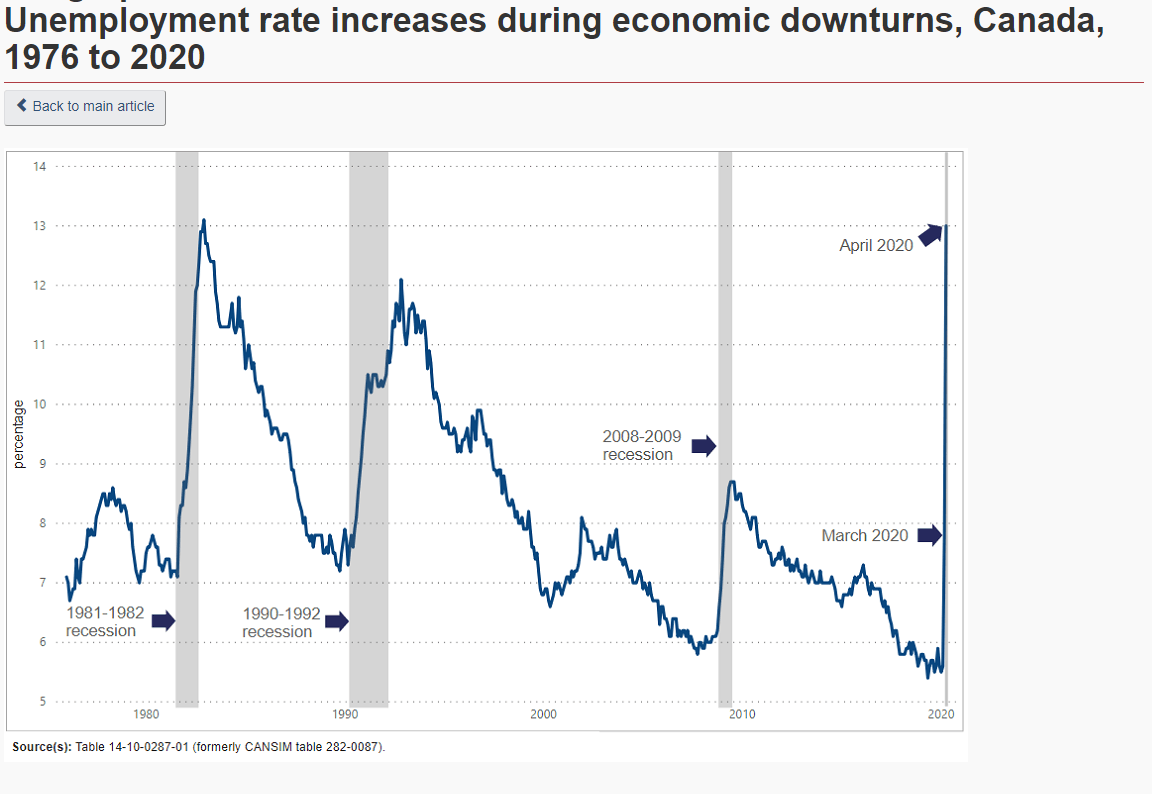

Employment in Canada collapsed in April, with 2 million jobs lost, taking the unemployment rate to 13.0%, just a tick below the prior postwar record of 13.2% in 1982 (see chart below). The record decline is on the heels of the 1 million job loss in March, bringing the cumulative two-month total to 15.7% of the pre-virus workforce.

Economists had been expecting double the job destruction--a 4 million position decline in April--in reaction to the reports that over 7 million Canadians had applied for CERB. Today's news reflected labour market conditions during the week of April 12 to April 18. The applications for CERB are more recent, so we may well see these additional losses reflected in the May report.

The 13% unemployment rate underestimates the actual level of joblessness. In April, the unemployment rate would have been 17.8% if the labour force participation rate had not fallen. Compared to a year ago, there were 1.5 million more workers on permanent layoff not looking for work in April - and so not counted as unemployed.

Also, the number of people who were employed but worked less than half of their usual hours for reasons related to COVID-19 increased by 2.5 million from February to April. As of the week of April 12, the cumulative effect of the COVID-19 economic shutdown—the number of Canadians who were either not employed or working substantially reduced hours—was 5.5 million, or more than one-quarter of February's employment level.

In April, both full-time (-1,472,000; -9.7%) and part-time (-522,000; -17.1%) employment fell. Cumulative losses since February totalled 1,946,000 (-12.5%) in full-time work and 1,059,000 (-29.6%) in part-time employment.

Decline In Employment Is Unprecedented

The magnitude of the decline in employment since February (-15.7%) far exceeds declines observed in previous labour market downturns. For example, the deep 1981-1982 recession resulted in a total employment decline of 612,000 (-5.4%) over approximately 17 months.

More of the drop in employment now is the result of temporary layoffs. In April, almost all (97%) of the newly-unemployed were on temporary layoff, whereas in previous recessions, most of the dismissals were considered permanent.

In April, more than one-third (36.7%) of the potential labour force did not work or worked less than half of their usual hours, illustrating the continuing impact of the COVID-19 economic shutdown on the labour market.

But job losses were also still weighted, on balance, more heavily in lower-wage jobs. Average wage growth for those remaining in employment spiked sharply higher as a result to 11% above year-ago levels.

All provinces have been hard-hit

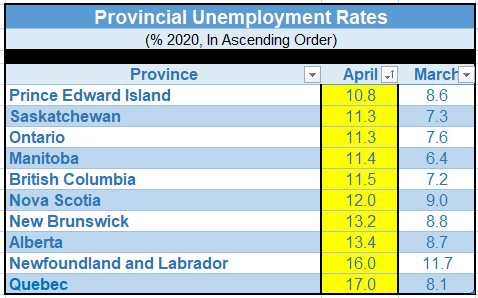

Employment declined in all provinces for the second month in a row. Compared with February, employment dropped by more than 10% in all regions, led by Quebec (-18.7% or -821,000). Quebec leads the country in the number of COVID-19 cases and deaths.

The unemployment rate rose markedly in all provinces in April. In Quebec, the rate rose to 17.0%, the highest level since comparable data became available in 1976, and the highest among all provinces (see table below). The number of unemployed people increased at a faster pace in Quebec (+101.0% or +367,000) than in other regions.

Employment dropped sharply from February to April in each of Canada's three largest census metropolitan areas (CMAs). As a proportion of February employment, Montréal recorded the largest decline (-18.0%; -404,000), followed by Vancouver (-17.4%; -256,000) and Toronto (-15.2%; -539,000).

In Montréal, the unemployment rate was 18.2% in April, an increase of 13.4 percentage points since February. In comparison, the unemployment rate in Montréal peaked at 10.2% during the 2008/2009 recession. In Toronto, the unemployment rate was 11.1% in April (up 5.6 percentage points since February), and in Vancouver, it was 10.8% (up 6.2 percentage points).

Employment Losses By Sector

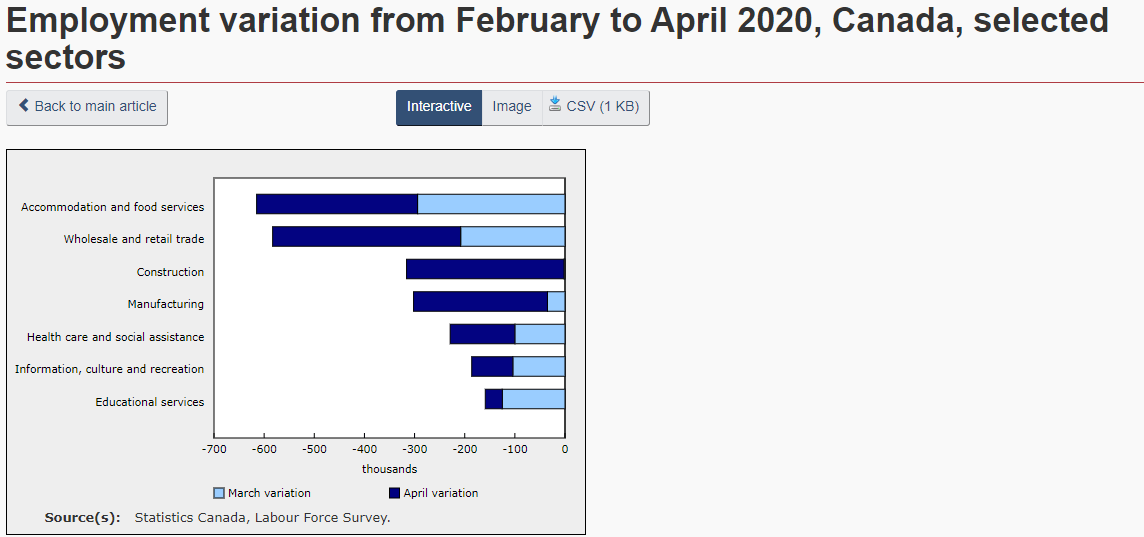

In March, almost all employment losses were in the services-producing sector. In April, by contrast, employment losses were proportionally larger in goods (-15.8%; -621,000) than in services (-9.6%; -1.4 million). Losses in the goods-producing sector were led by construction (-314,000; -21.1%) and manufacturing (-267,000; -15.7%).

Within the services sector, employment losses continued in several industries, led by wholesale and retail trade (-375,000; -14.0%) and accommodation and food services (-321,000; -34.3%).

Industries that continued to be relatively less affected by the COVID-19 economic shutdown included utilities; public administration; and finance, insurance and real estate.

In both the services-producing and the goods-producing sectors, the employment decreases observed in the two months since February were proportionally larger than the losses observed during each of the three significant labour market downturns since 1980.

As economic activity resumes industry by industry following the COVID-19 economic shutdown, the time required for recovery will be a critical question.

After the previous downturns, employment in services recovered relatively quickly, returning to pre-downturn levels in an average of four months. On the other hand, it took an average of more than six years for goods-producing employment to return to pre-recession levels following the 1981-1982 and 1990-1992 recessions. After the 2008-2009 global financial crisis, it took 10 years for employment in the goods-producing sector to return to pre-crisis levels.

|

This article was written by Dr. Sherry Cooper, DLC's Chief Economist, and was originally published on her newsletter.