the right broker for you.

Contact Us

We will get back to you as soon as possible

Please try again later

Contact Us

We will get back to you as soon as possible

Please try again later

Have Questions About the New Stress Test Rate? Here Are Some Answers…

The Department of Finance created shockwaves this week with its announcement that it will be revamping how insured mortgages are stress tested.

Now that the dust has settled, here’s a more in-depth look at the implications.

But first, a quick recap of what’s changing come April 6, 2020:

- Current stress test rate for insured mortgages (typically those with less than 20% equity): 5

. 19%

- Based on the Big 6 banks’ posted 5-year fixed rates.

- New stress test rate (if it were in effect today): ~4.89%

- Based on a rate equal to the weekly median 5-year fixed insured mortgage rate plus 2%.

Could the new benchmark rate eventually be higher than the current qualification rate?

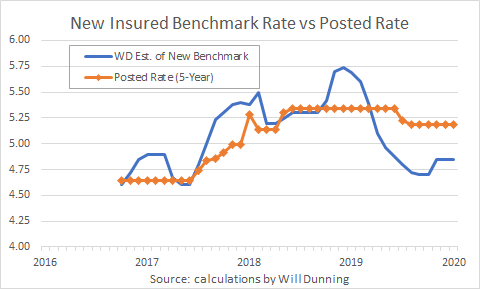

According to estimates from Mortgage Professionals Canada’s chief economist Will Dunning, yes.

He plotted his estimate of the typical “special offer” rate advertised by major lenders, and as recently as late-2018, the new qualifying rate would have been nearly 40 basis points higher than the new qualifying rate. Dunning notes, however, that it would be beneficial to have official data provided directly from the Canada Mortgage and Housing Corporation (CMHC) to remove some of the guess work from estimating the official average insured mortgage rate.

“Given the history, it’s highly possible that there will be future times when the new qualifying rate will be higher than the posted rate, but I don’t see that as important: the posted rate should never have been part of the mortgage stress tests,” Dunning told CMT.

How will the rate be calculated, exactly?

That’s still to be determined, at least publicly. The Bank of Canada says it can’t confirm if the new benchmark rate will be based on all insured applications (such as 2- to 4-unit properties, self-employed borrowers, second homes, rental properties, etc.) or just a core group.

How much of the mortgage market will be impacted by the stress test rate change?

As of 2018, insured mortgages accounted for less than a third of new mortgages. Although, the Office of the Superintendent of Financial Institutions (OSFI) announced it is also considering a similar change in its formula for stress testing uninsured mortgages (those with less than 20% equity).

How much does it help the average buyer?

There’s no question the new formula for stress testing insured mortgage will help many buyers who are currently just on the cusp of being able to pass the stress test.

Consider that the current stress test rate of 5.19% is a full 283 basis points higher than the lowest available insured mortgage rate on the market.

The new formula will narrow that gap by 30 basis points after April 6. This will decrease the income required to buy a $300,000 home by roughly $1,500, assuming a 5% down payment and 25-year amortization.

Alternatively, it will allow those who can easily pass the stress test to purchase about 5% more home. As Ron Butler of Butler Mortgage Inc. told us, “Someone who qualified for a $500K mortgage (previously) will qualify for $525K in April.”

Does the move go far enough to help buyers?

It depends on who you ask. Industry representatives say the changes are welcome, but that there’s still room for improvement to assist young and aspiring homeowners struggling to enter the housing market.

“A stress test at 4.89% is better than one at 5.19%, but this test threshold is still too high, for several reasons,” MPC’s Chief Economist Will Dunning told CMT.

“Most importantly, the tests fail to acknowledge that by the time of a renewal in five years, the borrower’s income will have increased, usually by more than 10%, and they will have more capacity to make payments. The calculations should, but don’t, take this into consideration.”

Dunning adds that after a five-year term of the borrower faithfully making payments, the outstanding principal will have been reduced by 14-15%. “The design of the test doesn’t properly account for this, and therefore it over-estimates how much the payments would increase. And, it increasingly looks unlikely that rates will rise by anywhere near the 2 percentage points that the revised test will assume.”

Paul Taylor, President and CEO, Mortgage Professionals Canada told BNN Bloomberg that he’s not sure if the change will help qualify a “tremendous” number of additional buyers.

“It certainly will help some folks on the margin,” he said. “But it’s certainly good news for the marketplace from a policy perspective.”

Taylor added the association would like to see the test closer to 75 basis points above a buyer’s contract rate (as opposed to 200 bps) based on calculations that take into account income growth and mortgage principal payment over the term of the mortgage.

Responding to concerns of the change contributing to increased home prices, Taylor said this: “I think the lack of supply is really what is causing the increase in those prices. There are just far more people than there are housing products available for them. This particular change…is not really going to affect the prices in isolation. I think it’s the rest of the dynamics in the market that are going to create the increases that everybody is expecting.”

If you have any questions about how the new stress test could impact your mortgage application, please don't hesitate to contact any of our Canadian Mortgage Experts.

This article was written by Steve Huebl from Canadian Mortgage Trends and originally published on Feb 21st 2020, we used a portion of the article to share on our blog!

QUICK LINKS

HEAD OFFICE

Copyright © 2023 DLC Canadian Mortgage Experts. All Rights Reserved | Privacy & Content Policy