Canadian Unemployment Rate in August Falls to 6.2%

The Bank of Canada told us just last week that they would be closely monitoring the employment data to assess the need for further tightening in monetary policy. The August jobs report confirmed that the Canadian labour market remains strong, moving closer to full employment.

The country added 22,200 jobs in August, the ninth consecutive month of employment gain, beating expectations once again. The unemployment rate fell to 6.2%, its lowest level since the financial crisis. Tighter labour markets pushed average hourly wage gains up 1.8%, the highest since October 2016. The 1.8% rise in earnings in August compares to 1.2% in July and a low in April of 0.5%. Also, hours worked were up 2.2%, the biggest gain in two years. Indications of increasing wage pressure provide validation of the Bank of Canada 25 basis point hike in the overnight rate to 1.0% that followed a similar increase at the policy meeting in July.

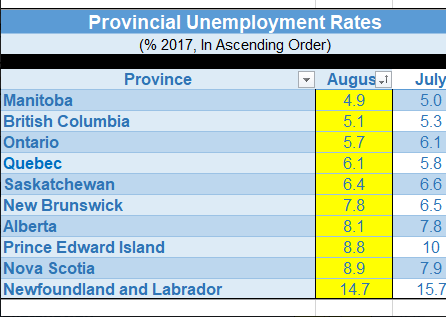

Provincially, Ontario was the only province with notable jobs gains in August. Employment declined in Nova Scotia and was little changed in the other provinces (see table below).

Employment has been rising at its fastest pace in almost a decade, boosting incomes and helping to fuel what many consider to be a consumer spending binge. Household debt-to-income continues to rise–a prolonged concern of the Bank of Canada and the federal government. With second-quarter GDP growth at a whopping 4.5%, Canada’s economy is the fastest growing in the Group of Seven.

The Bank of Canada meets again on October 25th. By that time, they will have seen the September employment report as well. Another strong report may increase the BoC’s resolve to continue to raise interest rates, particularly if wage gains accelerate further.

The details of today’s report were not as strong as the headlines suggest. The overall job gain masks a sharp drop in full-time work, which was down by 88,100. Part-time employment, which is less desirable, was up 110,400. Most of the decline in full-time employment occurred for youth aged 15 to 24. The overall employment decline for youth was accompanied by a notable decrease in their labour force participation as fewer young people looked for work. But job numbers in this age category are often distorted this time of year by back to school and summer job factors.

Another negative, self-employed workers, including unpaid workers in family businesses, were responsible for the full increase in total employment. Also, goods-producing industries posted a 13,700 decline, ending their five-month run of job gains. That was due to an 11,100 drop for manufacturers.

If we continue to see above-potential growth in the economy, as I expect, and consumer price inflation starts to trend closer to the 2% target, the Bank of Canada is likely to continue to tighten. I expect the benchmark overnight interest rate to rise 100 basis points to 2.00% by the end of 2018. To reach the 2% level implies four more rate hikes by the end of next year.

This post was written by Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres. It was originally published here.