Canadian Q2 GDP Growth Plunge--Rebounds Since April

Canadian Economy Took a Record Nosedive in Q2

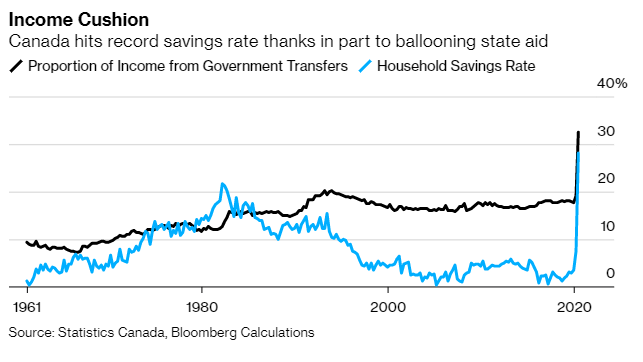

Government Provided A Much-Needed Cushion

Household disposable income surged last quarter despite the pandemic thanks to government income support (see chart below). The rise in income, coupled with the massive decline in consumer spending as well as the deferral of mortgage payments for many triggered a surge in the savings rate. The household saving rate jumped to 28.2% from 7.6% in the prior quarter. Savings rates, of course, are generally higher for higher income brackets.

Bottom Line

The plunge in economic activity in the second quarter--though awful--was not as deep as the Bank of Canada expected (-43%) in its most recent Monetary Policy Report. As well, the rebound since the end of April has been stronger than expected, especially in the housing sector. To be sure, labour market conditions are still very soft with the jobless rate at 10.9% in July, but the new programs announced last week by the federal government to replace CERB will help ease the transition for people still looking for work.

A possible resurgence in the virus remains a risk unless an effective vaccine can be distributed. The economy will operate below capacity into the next year, but perhaps not as drastically below capacity as previously feared.