Canada’s Jobless Rate Returns To 40-Year Low

Statistics Canada announced this morning that Canada’s jobless rate returned to a four-decade low as job growth rebounded, confirming that the jobs market is at or near full-employment.

Canada added 15,400 net new jobs last month as the unemployment rate edged downward to 5.8%, its lowest level in records back to 1976. This follows January’s 88,000 job loss. However, the gains reflected a rise in part-time employment, which was up 54,700. Full-time jobs were down by 39,300, a reversal in the January performance and the first time in five months that full-time employment has fallen. Full-time positions have been responsible for most of the boom in jobs in the past year and a half, jumping by nearly 500,000 net new ones over that period.

Wage growth decelerated to 3.1% in February, after hitting 3.3% a month earlier, its fastest pace since 2015. Salary gains were boosted last month by the Ontario hike in minimum wages.

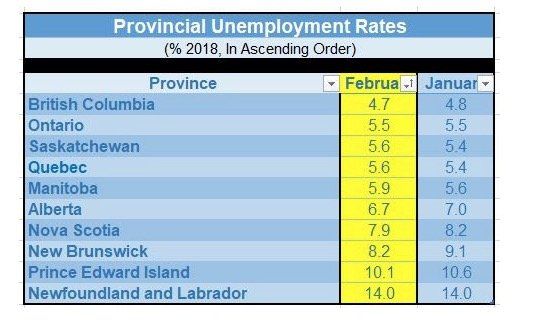

Ontario recorded the most substantial monthly drop in employment in January ( down 50,900) on the heels of the wage hike. The province led job growth in February but made up only a small part of January’s loss with only 15,700 net new jobs. Employment was also up in New Brunswick and Nova Scotia, while it decreased in Saskatchewan and was little changed in B.C. Of note, Alberta’s unemployment rate fell to 6.7%, a 1.5 percentage point decline over the past year, as the provincial participation rate fell slightly in February.

The bulk of the gains were in the public sector (+50,300), while the private sector added 8,400 net jobs. Holding back the overall pace of gains was a decline in self-employment, down 43,300 in February after four months of net increases.

The gain last month was driven by services-producing industries, particularly health care and education. Manufacturing recorded a loss of 16,500 workers during the month. The number of people working in natural resources rose 7,600 in February, bringing the year-over-year employment growth to 3.4%. Employment in this industry has been trending higher since the second half of 2016.

The finance, insurance, real estate, rental and leasing industry–heavily impacted by the slowdown in housing–experienced a drop in employment of 12,000 last month, posting no growth on a year-over-year basis.

Today’s employment release is consistent with Canadian growth of roughly 2.0%. The February net gain of 15,400 is probably about what we can expect on average this year as the economy bumps up against full capacity. At 3.1% in February, wage growth posted a fourth consecutive month above its longer-term average of 2.6%. This will not set off inflation warnings at the central bank as the Bank of Canada reported this week that it still assesses wage growth to be below what is normal in an economy without labour market slack. This suggests the Bank will maintain its cautious stance.

This article was taken from a portion of Dr. Sherry Cooper’s newsletter update sent on March 9th 2018. Dr. Sherry Cooper is DLC’s Chief Economist.