the right broker for you.

Contact Us

We will get back to you as soon as possible

Please try again later

Contact Us

We will get back to you as soon as possible

Please try again later

Bank of Canada Announcement | Bank Holds Rates Steady For Now

Poloz Holds Rates, Sees More Room For Growth and Rising Inflation

The Canadian dollar fell sharply immediately after the release of the Bank of Canada’s Official Statement providing a more bullish forecast for the economy while holding rates steady. The Bank hiked its estimate of noninflationary potential growth, implying there was more room to grow without triggering rate hikes. The central bank now suggests the economy has a noninflationary speed limit of 1.8% this year and next, accelerating to 1.9% in 2020. Formerly, the Bank had estimated potential growth to average about 1.6% for the next two years.

Many market participants had expected a more hawkish statement as inflation has risen to close to the Bank’s 2%-target in recent months. The central bank appears to be straddling the fence, suggesting that rate hikes are coming, but the economy still needs stimulus. The good news is that growing demand is generating new capacity as businesses invest to meet sales, a development that Governor Poloz says the central bank has an “obligation” to nurture.

The Monetary Policy Report (MPR) notes that three-quarters of industries have a capacity utilization rate within five percentage points of their post-2003 peak. The business outlook survey, meanwhile, indicates that sales expectations have firmed. Taken together, this implies that there’s a real need for investment to meet higher demand.

The chief concern is that protectionism, which remains the central bank’s top risk to the outlook, coupled with the U.S. tax overhaul means businesses will choose to expand capacity outside of Canada. A “wide range of outcomes” is still possible for the NAFTA, according to the MPR, which did not acknowledge recently reported progress in talks between Canada, Mexico, and the U.S.

The central bank now sees first-quarter growth at 1.3%, down from a January forecast of 2.5%. Forecasts for 2018 were also brought down to 2%, from 2.2%. But 2019 growth was revised up to 2.1% from 1.6%. This stronger growth profile reflects upward revisions to the U.S. fiscally induced expansion.

Slower growth in the first quarter primarily reflected weakness in two areas. Housing markets slowed in the wake of the new mortgage guidelines. Exports also slowed, in part owing to transportation bottlenecks.

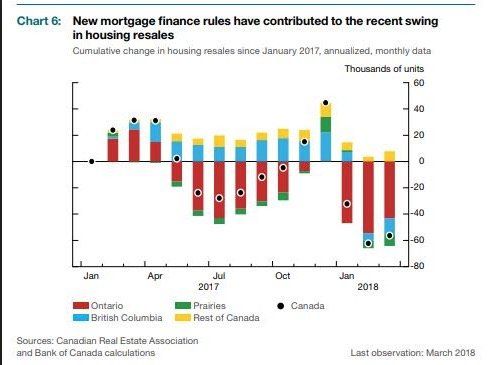

Concerning housing, the Monetary Policy Report contained an interesting chart (below) showing the cumulative change in housing resales since January 2017 with the following comment: “Housing activity is estimated to have contracted sharply in the first quarter, following the implementation of the revised B-20 Guideline. The contraction was amplified as some homebuyers acted quickly in the fourth quarter of 2017 to purchase a home before being subject to the new measure. In the second quarter of 2018, housing activity is expected to pick up as resales start to recover.”

Bottom Line: Despite upward revisions to inflation, the Bank’s assessment seems to be relatively sanguine. I expect two more quarter-point rate hikes this year–likely in the summer and fall.

Announcement from the Bank of Canada

The Bank of Canada today maintained its target for the overnight rate at 1 ¼ per cent. The Bank Rate is correspondingly 1 ½ per cent and the deposit rate is 1 per cent.

Inflation in Canada is close to 2 per cent as temporary factors that have been weighing on inflation have largely dissipated, as expected. Consistent with an economy operating with little slack, core measures of inflation have continued to edge up and are all now close to 2 per cent. The transitory impact of higher gasoline prices and recent minimum wage increases will likely cause inflation in 2018 to be modestly higher than the Bank expected in its January Monetary Policy Report (MPR) , returning to the 2 per cent target for the rest of the projection horizon.

The global economy is on a modestly stronger track than forecast in January, with upward revisions to growth and potential output in a number of major advanced economies. The outlook for the U.S. economy has been further boosted by new government spending plans. However, escalating geopolitical and trade conflicts risk undermining the global expansion.

In Canada, GDP growth in the first quarter was weaker than the Bank had expected, but should rebound in the second quarter, resulting in 2 per cent average growth in the first half of 2018. The economy is projected to operate slightly above its potential over the next three years, with real GDP growth of about 2 per cent in both 2018 and 2019, and 1.8 per cent in 2020. This stronger profile for GDP incorporates new provincial and federal fiscal measures announced since January. It also reflects upward revisions to estimates of potential output growth, which suggest the Canadian economy has made some progress in building capacity.

Slower economic growth in the first quarter primarily reflects weakness in two areas. Housing markets responded to new mortgage guidelines and other policy measures by pulling forward transactions to late 2017. Exports also faltered, partly owing to transportation bottlenecks. Some of the weakness in housing and exports is expected to be unwound as 2018 progresses.

The Bank anticipates that Canadian exports will strengthen as foreign demand increases, but not sufficiently to recover the ground lost during recent quarters. Export growth is being increasingly limited by capacity constraints in some sectors. Continued gains in business investment should build additional capacity in those sectors and in the economy more generally. However, both exports and investment are being held back by ongoing competitiveness challenges and uncertainty about trade policies.

Growth in consumption remains robust, supported by strong labour income growth. Wages have continued to pick up as expected, even after factoring out recent minimum wage increases in Ontario and Alberta. The Bank will continue to assess labour market data for signs of remaining slack.

Some progress has been made on the key issues being watched closely by Governing Council, particularly the dynamics of inflation and wage growth. This progress reinforces Governing Council’s view that higher interest rates will be warranted over time, although some monetary policy accommodation will still be needed to keep inflation on target. The Bank will also continue to monitor the economy’s sensitivity to interest rate movements and the evolution of economic capacity. In this context, Governing Council will remain cautious with respect to future policy adjustments, guided by incoming data.

This was the third announcement in 2018, here are the announcements dates set out for the remainder of 2018.

- May 30th 2018

- July 11th 2018*

- September 5th 2018

- October 24th 2018*

- December 5th 2018

*Monetary Policy Report published

QUICK LINKS

HEAD OFFICE

Copyright © 2023 DLC Canadian Mortgage Experts. All Rights Reserved | Privacy & Content Policy