the right broker for you.

Contact Us

We will get back to you as soon as possible

Please try again later

Contact Us

We will get back to you as soon as possible

Please try again later

How to Measure Your Productivity

One of the biggest problems with new year’s resolutions is that they are hard to keep. We all have the best intentions, but sometimes life gets in the way.

Enter productivity expert Chris Bailey from A Life of Productivity,Chris teaches from his life experiences (and experiments) and knows a thing or two about how to get things done.

Let’s say you’re looking to save up a downpayment on a new house, pay down some debts, repair your credit, or just get yourself in an overall better financial position, being intentional about your choices is the only way to make real progress .So if you find your resolve waning, and you need some motivation, here’s an article that might help keep you on track!

How to Measure Your Productivity

Takeaway: Productivity is all about accomplishing what we intend to—that’s why we should measure our productivity against our intentions.

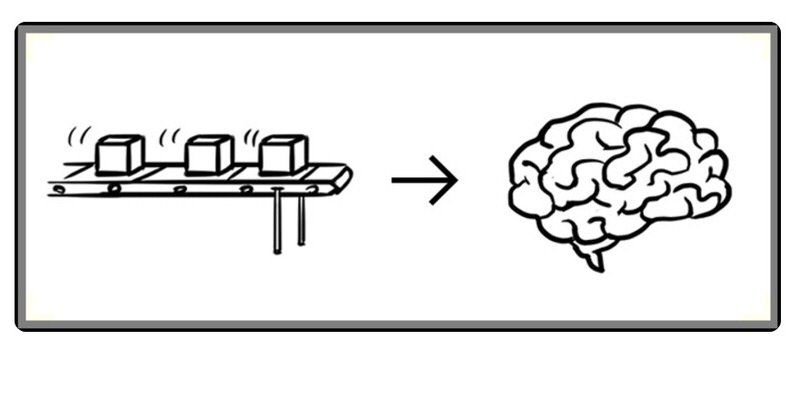

A shift occurred several decades ago that completely uprooted what being productive meant: we started doing knowledge work with our brains, rather than assembly line work with our bodies.

Productivity meant something very different with assembly line work. If we were efficient and produced a ton of widgets during our shift, we were productive. This definition doesn’t work today. It’s easy to be efficient on the wrong things—like if we were to follow 10,000 people on Twitter, and become ultra-efficient at keeping up with every one of them.

In a similar way, a lot of people equate productivity with getting more done . But simply getting more done doesn’t make us more productive. If one day you have four pointless meetings, hop on two conference calls to update your boss on your quarterly budget, read every news story, and catch up with the unimportant email you’ve received, you’ve gotten a lot of stuff done, but it didn’t necessarily move your work forward in a meaningful way.

Another productivity definition that comes close, but just misses the mark, is getting more important stuff done . This idea works most of the time. But what if the most productive thing you could do one day is totally step back from your projects, so you’re able to recharge and work with more energy later on? Or what if it’s the weekend, and the most meaningful way you could spend your time is to disconnect and spend time with your family?

I’d argue that none of these definitions work well today.

With the knowledge-based work we do today, we are productive when we accomplish what we intend to.

My favorite word in the English language is intention. Working with intention is all about focusing on what’s important—and doing so with purpose. When we live with intention outside of work, we create a more meaningful life for ourselves at home.

Intention is also what makes us human. Other animals can’t step back from what they’re doing, imagine several potential futures, and then choose the most productive and meaningful path. This intention-based definition of productivity also accounts for the fact that energy and focus are a critical component of productivity—and recognizes that sometimes doing nothing at all is key to recharging so we can become more productive later on.

To measure your productivity against your intentions, you need to carve out intentions for yourself in the first place.

We’re the most productive when we work and live intentionally. As a result, intentions are the meter stick we should measure our productivity against.

QUICK LINKS

HEAD OFFICE

Copyright © 2023 DLC Canadian Mortgage Experts. All Rights Reserved | Privacy & Content Policy